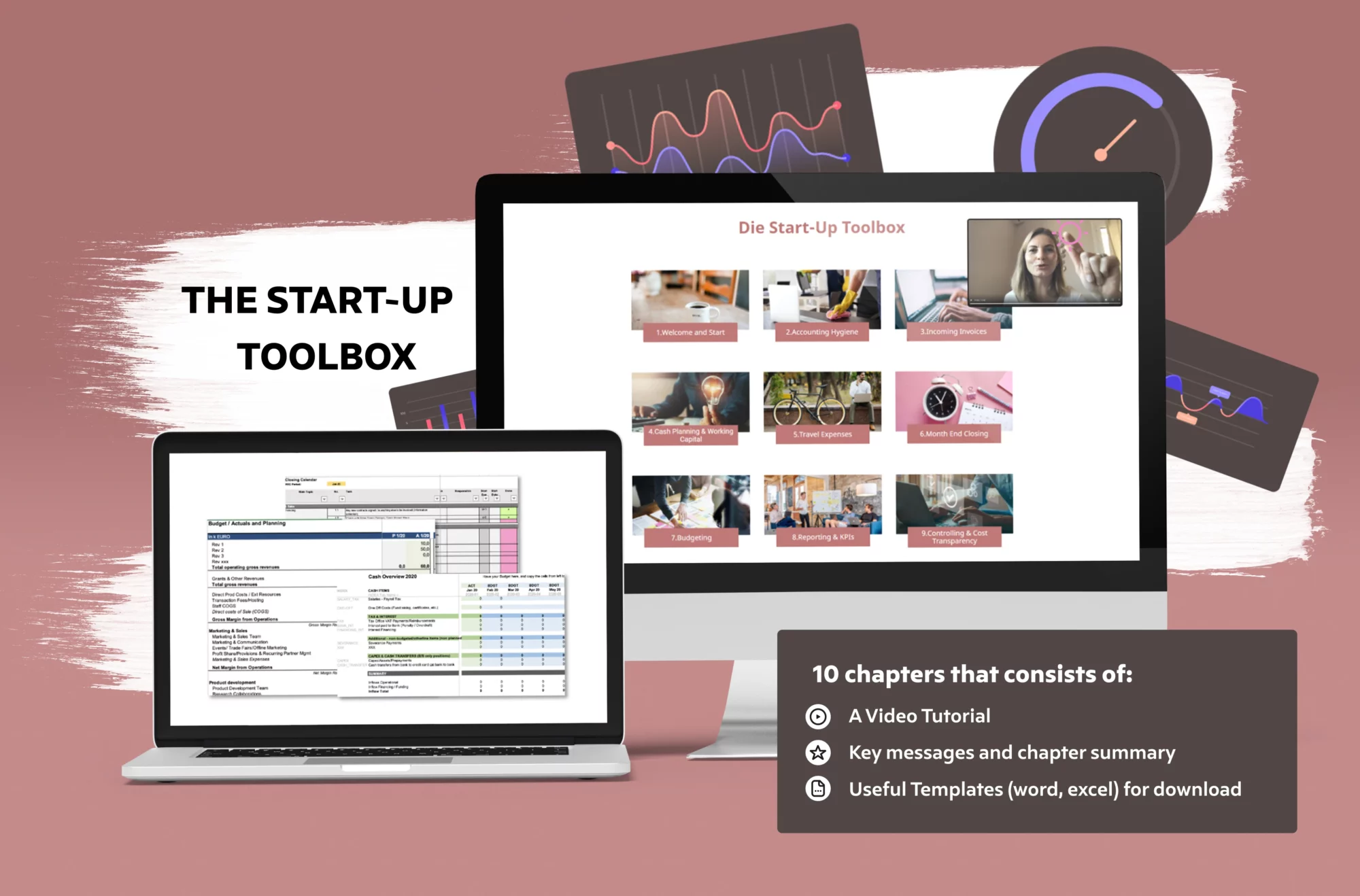

Starting a business involves planning, making key financial decisions, and getting your head around bookkeeping, taxes, revenue, and legal requirements. Now you can get the accounting toolbox with the best financial and accounting templates for small businesses.

Timesaving templates in the Financial Toolbox

With the ready-to-use templates you’ll have your bookkeeping organized in no-time. You can use the worksheets for the financial planning of your business, prepare the taxes, manage your revenue, and more. The accounting toolbox provides you the foundation for your accounting and bookkeeping. With the handy tax and accounting templates at your fingertips, you can meet your business’ needs.

An all-in-one Toolbox for your Small Business Accounting

The all-in-one package includes all steps of implementing structured finance processes and accounting structures. The toolbox with the templates and guidelines lays a solid foundation upon which you can set your assumptions and make your own customisations.

The Financial Toolbox is a Time & Money Saving help

With the toolbox, you save time and money to get your financial processes automated:

- All the bookkeeping and accounting needs of an early stage start-up are covered

- The toolbox is complete and makes other resources redundant.

- All templates can be used internationally.

- Including videos with explanations and instructions.

You don’t have to spend your budget on expensive tools to get your business finance organized

All excel templates in the accounting toolbox are easy to use without making huge adjustments, while anything can be edited if needed. These are professional spreadsheets to start building up your finance department from day 1.

All excel templates include my own experience, lessons learned and are down to earth. Together with the templates you get best practice tips from an expert for a crisp and easy accounting set-up. With the all-inclusive template and guideline package your time as a founder & your finance team is valued and you don’t need to spend time inventing your own templates and guidelines from scratch.

Why start NOW?

9 out of 10 start-ups unfortunately fail and almost 20% due to financial issues:

surprised by a too short runway

no clean set of numbers to make vital decisions

lack of a clean foundation for financial data

flying receipts or lost receipts

There is a misperception in early stage startups that implementing financial processes takes too much time and that it is not vital for success. Founders are focussing on their ideas and make business development a priority – OF COURSE!!! But quickly they realise that without good data as a foundation it is super difficult to take decisions and to predict the runway. I would like to change that and talk more about how easy finance can be if you have the right tools – even without a budget.

As a consequence, there is a lot of chaos in accounting, the wrong tax advisor, the wrong hires, a poor basis of figures. This often leads to wrong decisions and also problems with audits, tax office, initial due diligence, etc. There is always a lot of talking about digitalisation and automation. Which is good, but rarely about how hard it is to set up financial processes from scratch or that many start-ups also fail because they make the wrong decisions, are surprised by a short runway, etc. This is all due to the fact that in the beginning there is a lack of transparency. This is all because there is no time for accounting in the beginning – understandably. I would like to change that and talk more about it.

Finance can be so easy if you have the right tools – even without a budget. I’ve already built up finances from scratch in companies several times and would like to help founders to create a good basis here easily and quickly. I have built a toolbox for this purpose. With templates, process descriptions and short & crisp videos.